How are Taxes currently handled in the PodPlay system?

NOTE: PodPlay is not a tax consultant. Please consult a tax expert for guidance on which revenue categories your business must collect and remit sales tax on per the state’s tax laws. PodPlay is not responsible for ensuring that you collect and remit your all sales tax properly and in accordance with your state and local tax laws.

Once taxes are collected, you are responsible for filing your sales tax returns and remitting the collected sales tax to your city/state accordingly.

Taxable Items

Taxes are configured in the PodPlay system with your PodPlay CSM.

Depending on your location, some revenue categories may be subject to sales tax while others are not. You may also require different sales tax rates depending on the category of products and services sold. Some examples of “revenue categories” are:

Private Reservations

Coaching lessons

Event Signups

Clinics

Memberships

Food & drinks

Merchandise

Default System Products (details below)

Front End

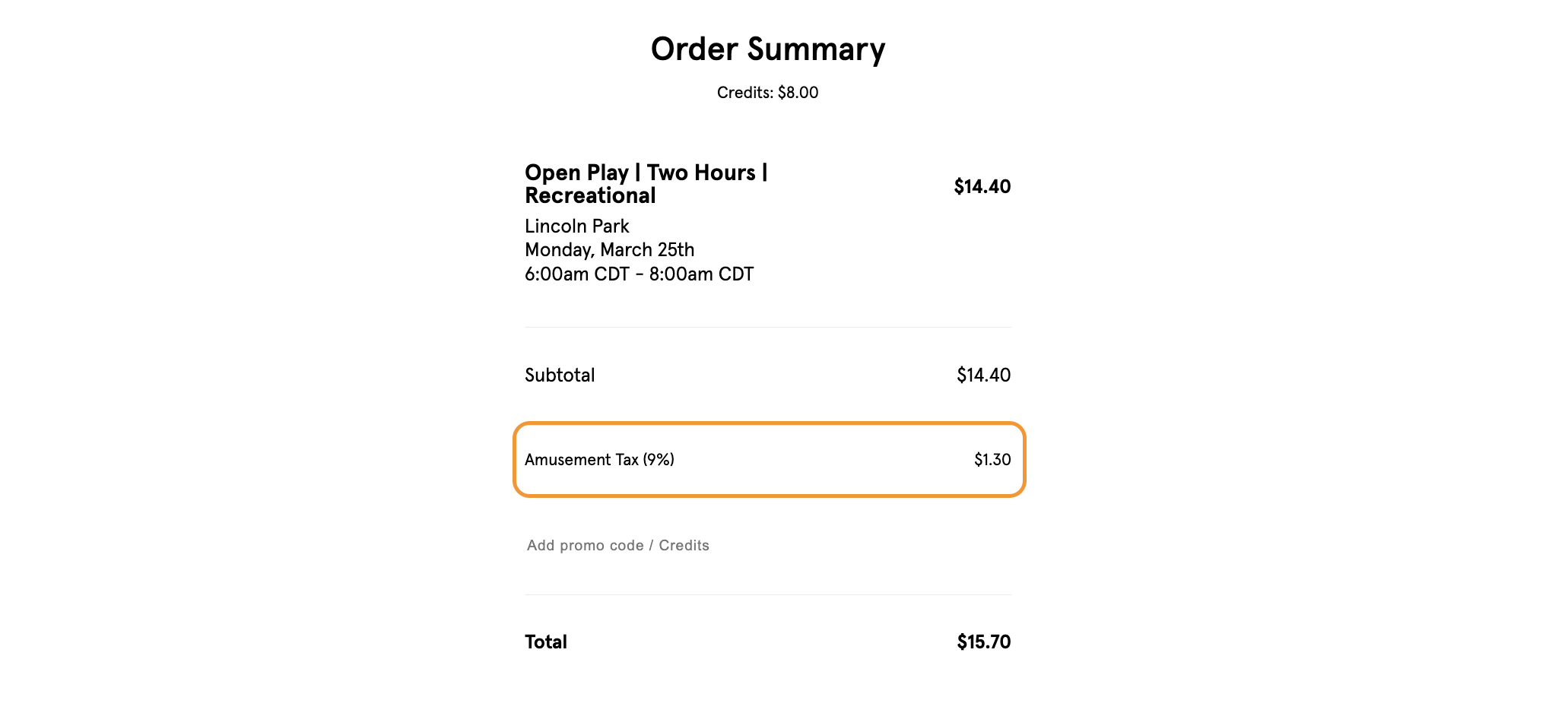

Once you know your required sales tax information, please share the tax matrix with your PodPlay CSM. The system allows for different tax rates to be added in the Customer purchase flow. For example:

One tax rate for booking a court Reservation

A different tax rate for Event signup

And a third tax rate for Private Events

Etcetera

The CSM will map the tax rates against the App's UX/UI so that when your Customers make Reservations and Events purchases through the App, there will be an explicit line item showing the sales tax they are being charged as part of the purchase.

You can then download your transaction history report in the Purchase page of the Dashboard, where sales tax will be included as a separate column.

Back End

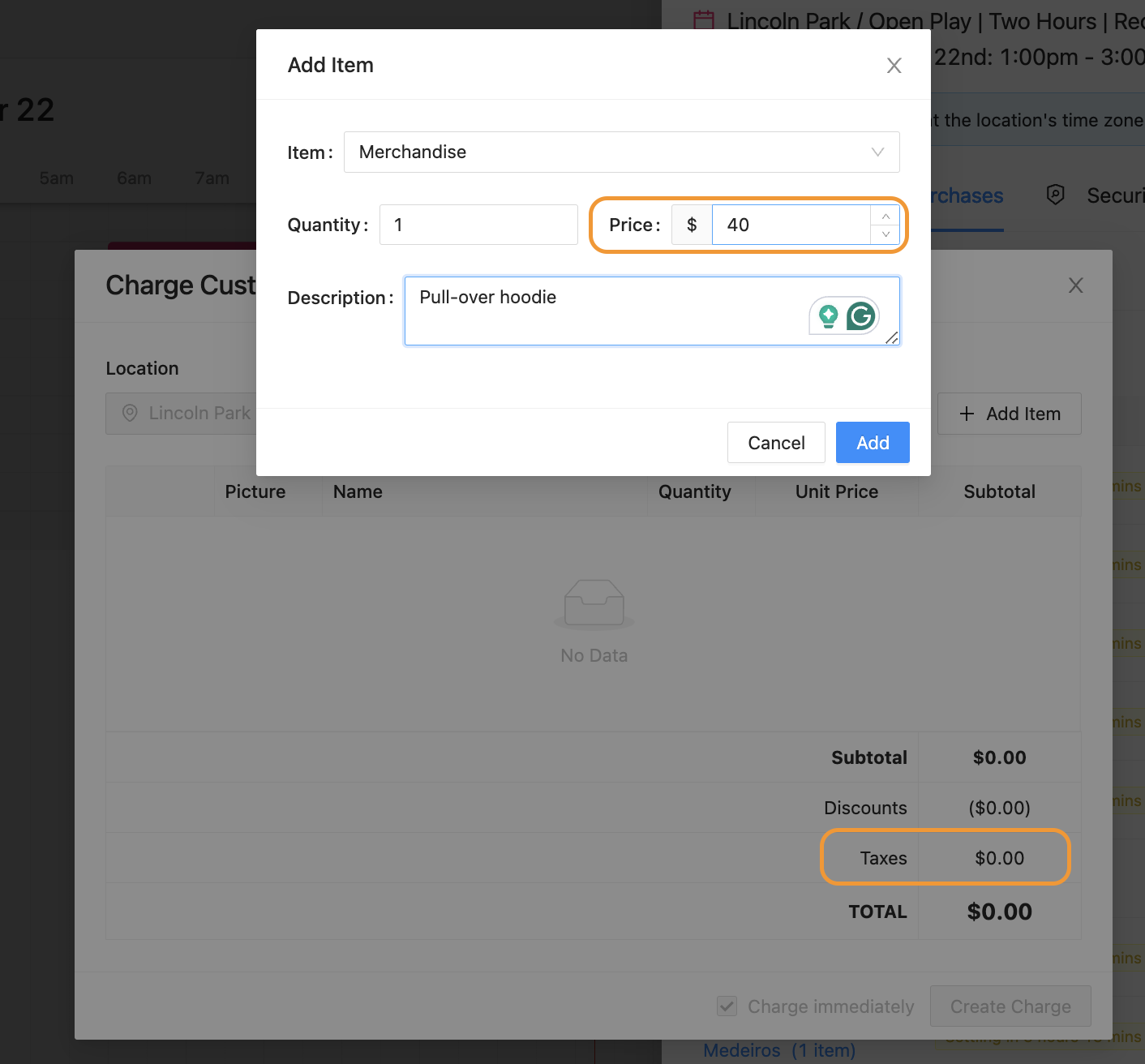

When an Admin charges a Customer from the Dashboard, taxes are automatically added, if you have shared your tax matrix with the CSM.

The line item for taxes will be visible and change depending on the cost of the item an Admin is manually charging, before completing the charge.

Revenue Categories in Detail

General Categories

BOOKING - used to tax the booking of a private Reservation

GUESTS - used to tax invitees on private Reservations (Court+) and when choosing the default system product from the Dashboard “Extra Guests”

GUEST_SPOT - used to tax invitees on private Reservations (Spot+, not used on Court+)

COACHING_SESSION - used to tax private Reservation lessons with a Coach (this can be added for taxes on lessons, and by taking BOOKING off, there’s no tax on Reservations)

EVENT_SIGNUP - used in conjunction with EVENT, CLASS, PRIVATE EVENT, and SERIES SIGNUP (this is necessary for the following four categories to function properly)

EVENT - used to tax Open Play, League, Tournament, or Party type Event signups

CLASS - used to tax Clinic of Kids Class type Event signup

PRIVATE_EVENT - used to tax Private Event type Event signup

SERIES_SIGNUP - used to tax Series type Event signup

MEMBERSHIP - used to tax Membership purchases

PRODUCT - used to tax the POS (point of sale) products GENERIC, WATER, FOOD, DRINKS, ALCOHOL, MERCHANDISE

Default System Items in the Dashboard

GIFT_CARD - used to tax the default system product “Gift Card”

PADDLE_RENTAL - used to tax the default system product “Paddle Rental”

CONVENIENCE_FEE - used to tax the default system product “Convenience fee”

INFRACTION_FINE - used to tax the default system product “Infraction Fine”

VARIOUS - used to tax the default system product “Various”

The default system items are in every Club’s environment and come as standard options when charging a Customer’s Profile in the Dashboard.

Remember

It is the Club’s responsibility to share your tax matrix with your CSM and to file on time.

Depending on the city and state your Club is located in, you may need to collect and remit sales tax on all of your products/services, some, or none. Once again, we recommend working with a tax advisor for assistance filing sales tax returns correctly and on time.